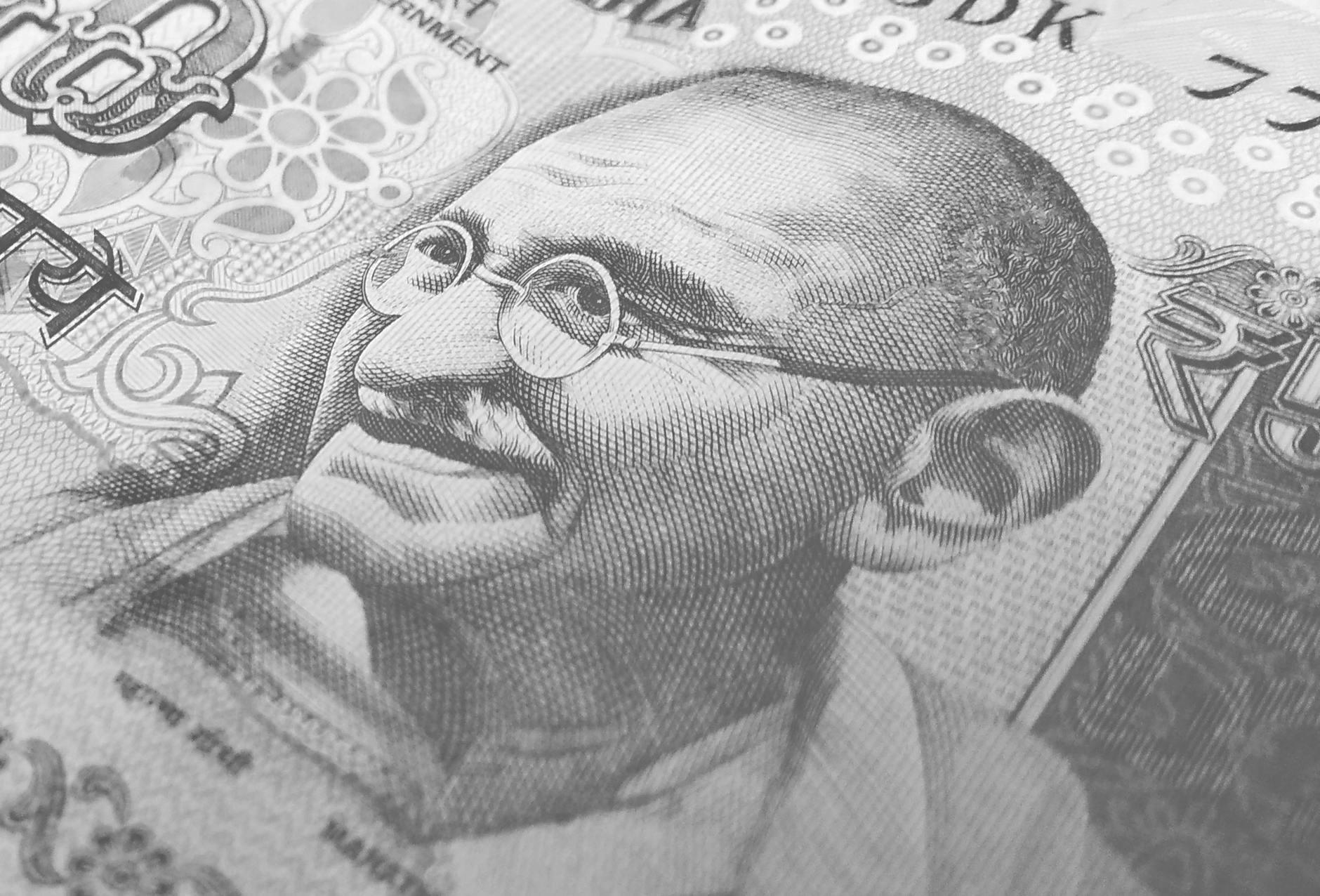

In a significant turn of events sending ripples of optimism across the nation, new economic figures reveal a dramatic deceleration in consumer price growth. This unexpected dip below forecasted levels in October is igniting widespread excitement, particularly regarding the potential for substantial financial relief for millions. The dramatic cooling of inflationary pressures is now strongly hinting at a pivotal shift in monetary policy, potentially ushering in an era of more affordable borrowing and invigorated economic activity.

Unpacking the October Surprise: What the Numbers Truly Mean for Indian Households

Recent data has unveiled that the rate at which everyday goods and services are becoming more expensive for Indian households has significantly slowed, registering a notable cooling trend last month. This welcome development signals a healthier economic environment, as households can anticipate their purchasing power to stretch further. Such a sharp deceleration in price hikes, which came in considerably lower than many analysts had predicted, is a crucial indicator, suggesting that the broader economy is stabilizing and moving towards a more predictable trajectory. It’s a testament to underlying economic resilience and strategic financial management.

The Road Ahead: Potential for Central Bank Action and Your Future Interest Rates

The remarkable slowdown in price escalation is creating strong anticipation for strategic maneuvers from the nation’s central bank. Financial experts and the public alike are now looking towards the monetary authorities with renewed hope for potential adjustments that could ease the cost of credit. Should the central bank opt to relax its monetary stance, it could translate into lower interest rates on loans for homes, vehicles, and businesses. This would effectively put more money back into the pockets of everyday citizens, stimulate investment across various sectors, and ultimately fuel a robust economic expansion.

This latest economic revelation paints an incredibly positive picture for the financial future of the nation. With inflation confidently on the retreat, the stage is set for a period of enhanced economic stability, potentially leading to significant financial benefits for consumers and businesses alike. The outlook is bright, promising a more buoyant economic landscape ahead!

Leave a Reply