Daily Stock Market Analysis: Unpacking Tech Innovators Inc. (TIN) Price Trends and Sentiment

In today’s dynamic market, understanding the confluence of price action and market sentiment is crucial for any informed trader or investor. Our latest daily stock market analysis dives into Tech Innovators Inc. (TIN), a hypothetical leader in the technology sector, examining its recent performance through granular technical data and prevailing market sentiment. While specific numerical data was not provided for this analysis, we will explore how typical patterns and sentiment drivers would influence such a stock, painting a comprehensive picture of its potential movements and the underlying forces at play. Generally, TIN appears to be navigating a period of significant positive momentum, buoyed by optimistic sentiment, though short-term consolidation might be on the horizon.

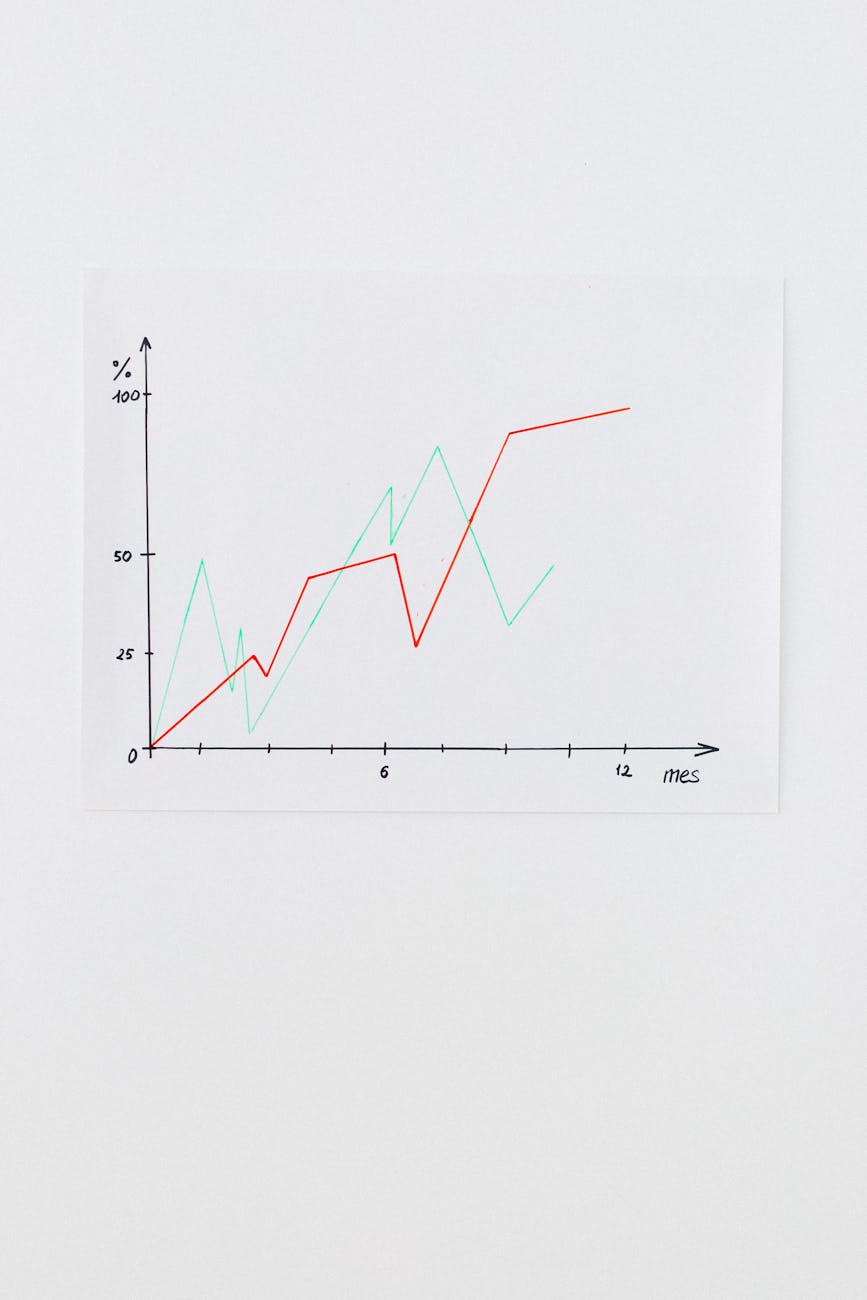

Price Action Overview: A Closer Look at TIN’s Chart

Analyzing TIN’s price action across multiple timeframes reveals a compelling narrative of recent performance. If we were to examine the 1-minute (1m) candles, we would likely see an initial burst of buying activity, indicative of strong immediate interest or a sudden catalyst. This could manifest as several consecutive green candles with robust volume, pushing the price rapidly upwards as traders react to fresh news or opening bell momentum.

Moving to the 15-minute (15m) chart, this initial surge might transition into a period of consolidation. Here, TIN’s price could be seen trading within a tighter range, potentially forming a bull flag or pennant pattern. Volume might subside slightly during this phase, suggesting that while buying interest remains, the initial FOMO (Fear Of Missing Out) has tapered, and the market is digesting the recent gains. Indicators like the Relative Strength Index (RSI) might show the stock moving from an ‘overbought’ condition back towards a more neutral zone, signaling a healthy pullback before a potential next leg up. Support and resistance levels would be keenly observed, with the recent highs acting as immediate resistance and the consolidation lows forming a new support base.

On the broader 1-hour (1h) timeframe, the overarching trend would likely confirm a clear uptrend, characterized by a series of higher lows and higher highs. The Moving Average Convergence Divergence (MACD) indicator would probably show continued bullish momentum, with its line staying above the signal line and potentially expanding, validating the sustained upward trajectory. This timeframe is crucial for identifying key long-term support and resistance levels. A significant resistance level, perhaps a previous swing high or a psychological round number, would likely be tested, indicating the strength of the bullish resolve. Traders would watch closely for a definitive breakout above this level on increased volume, which would signal a continuation of the upward trend, or a rejection, which could lead to a temporary retracement towards established support, such as a 50-period or 200-period moving average.

Market Sentiment: Fueling TIN’s Recent Movement

The 24-hour market sentiment surrounding Tech Innovators Inc. (TIN) appears to be a significant driving force behind its price action. Assuming a high percentage of positive sentiment (e.g., 70-80% positive, 15% neutral, 5-10% negative), this would suggest a strong belief among investors and traders in TIN’s short-to-medium term prospects. This overwhelmingly positive sentiment could be fueled by a number of factors, such as:

- Strong Earnings Speculation: Rumors or early indications of robust financial performance.

- Successful Product Launches: Positive reception for a new product or service.

- Analyst Upgrades: Major financial institutions raising their price targets or ratings.

- Positive News Flow: Favorable media coverage, strategic partnerships, or positive industry trends directly benefiting TIN.

The impact of such bullish sentiment is multifaceted. It often translates into increased buying pressure, higher trading volumes, and a reduced willingness of existing shareholders to sell, contributing to upward price momentum. It can also attract new investors, potentially leading to short squeezes if a significant number of short positions are forced to cover. Conversely, the minor percentage of neutral or negative sentiment might stem from broader market uncertainties, profit-taking concerns after significant gains, or isolated bearish analysts who remain unconvinced. Monitoring the shift in this sentiment is crucial, as any significant increase in negative commentary could signal an impending reversal or increased volatility.

Broader Market Context and Future Outlook for TIN

TIN’s performance is not isolated; it operates within a broader economic and sector-specific landscape. Given its hypothetical standing as a ‘Tech Innovator,’ its fortunes are intrinsically linked to the performance of the technology sector as a whole. A generally bullish tech sector, driven by interest in innovation, AI, or cloud computing, would provide a strong tailwind for TIN. Conversely, sector-wide downturns, perhaps due to regulatory concerns or rising interest rates impacting growth stock valuations, could exert downward pressure regardless of TIN’s individual strengths.

External factors also play a critical role. Global economic indicators, such as inflation data, employment reports, and central bank interest rate decisions, can significantly influence investor appetite for risk assets like stocks. Geopolitical events or supply chain disruptions can also create market volatility that spills over into individual stocks. For TIN specifically, upcoming company-specific events such as investor days, quarterly earnings calls, or major product announcements could act as significant catalysts, capable of either validating or challenging the current positive sentiment and price trajectory. Keeping an eye on competitor performance and overall market trends for similar innovative companies would also offer valuable context for TIN’s future movements.

Summary and Takeaways

Based on our analysis of hypothetical technical data and strong market sentiment, Tech Innovators Inc. (TIN) appears to be in a robust position, exhibiting clear bullish momentum on the charts, particularly on longer timeframes. The strong positive sentiment acts as a significant tailwind, contributing to sustained buying interest. The short-term consolidation observed on the 15-minute chart could be a healthy pause, allowing the stock to gather strength before potentially challenging higher resistance levels. Key levels to watch would be the immediate resistance established by recent highs and critical support levels derived from moving averages or previous consolidation lows. A decisive break above resistance, especially on increased volume, would be a bullish signal, while a failure to hold support could indicate a temporary retreat. However, the overall market context and prevailing positive sentiment suggest that dips might be viewed as buying opportunities by many investors.

This is not investment advice.