The surging interest in critical rare earth metals has captured the imagination of investors worldwide, promising lucrative returns in a vital and expanding market. However, a significant voice from within the industry has just issued a stark and surprising caution, urging market participants to temper their enthusiasm with a deep understanding of the unique and often challenging economic landscape defining this sector. This unexpected warning could reshape how many approach these sought-after commodities, highlighting a critical perspective often overshadowed by market hype.

Beyond the Hype: Understanding the Economic Realities of Critical Minerals

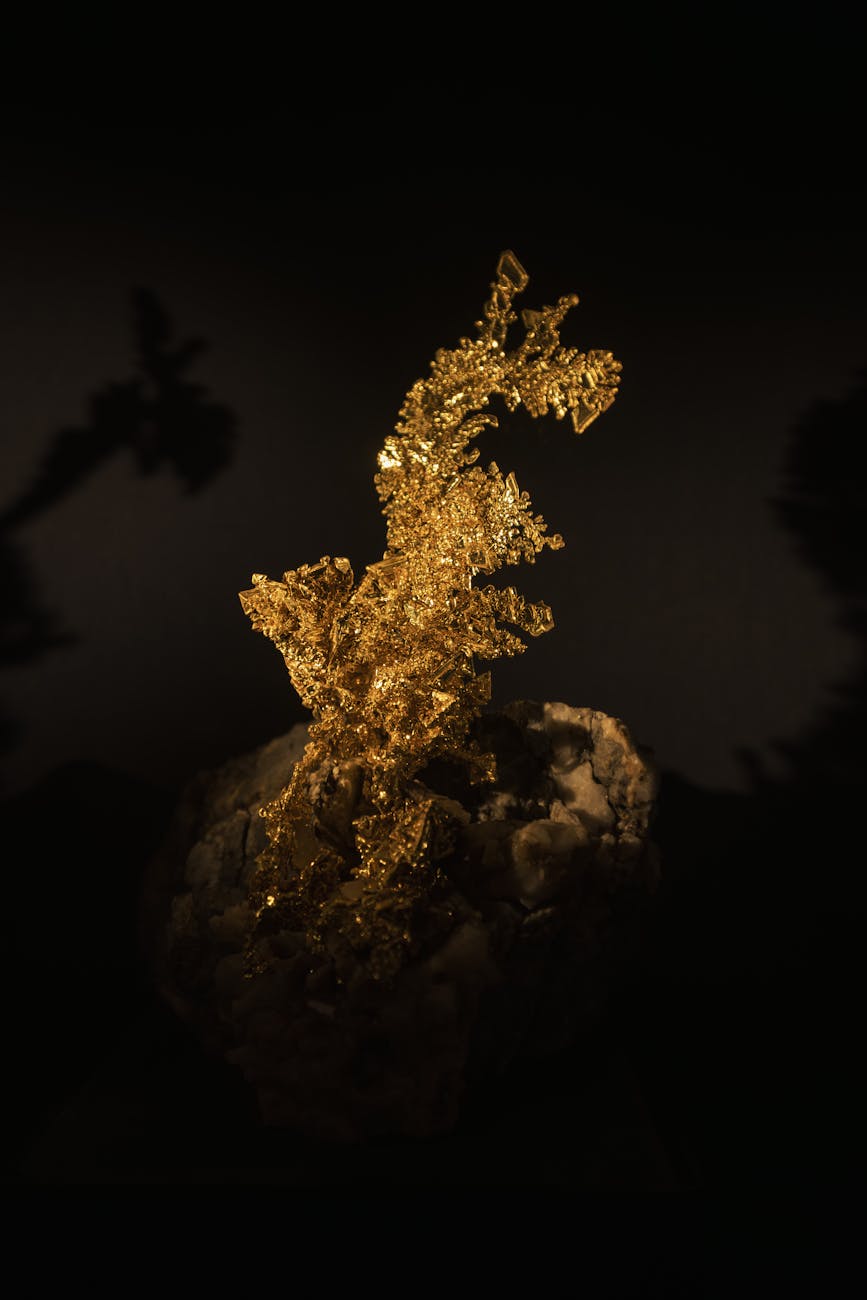

While headlines often trumpet the soaring demand for rare earths – essential components in everything from electric vehicles to advanced defense systems – the path to profitability within this industry is far from straightforward. Industry insiders point to a complex interplay of factors that can significantly impact financial outcomes, including the capital-intensive nature of mining and processing, the volatility of global commodity prices, and the intricate, often geopolitically influenced, supply chains. These elements combine to create a challenging environment where even seemingly robust projects can face substantial headwinds, making sustained returns a significant hurdle for those looking to invest in rare earth minerals.

Navigating the Nuances: Expert Advice for Astute Rare Earth Investors

The advice from a seasoned industry leader isn’t intended to deter participation but rather to empower investors with realistic expectations and a robust understanding of the market’s inherent risks. The call for caution is a clear signal that thorough due diligence is paramount. Prospective rare earth investors are strongly encouraged to look beyond immediate price surges, scrutinizing business models, operational efficiencies, and geopolitical exposure before committing capital. Without a comprehensive grasp of these underlying intricacies, the potential for significant financial setbacks in this dynamic market remains a tangible concern.

Ultimately, the message is clear: while the rare earth sector undoubtedly holds immense strategic importance and long-term potential, it is not a market for the unwary. By heeding expert warnings and approaching investments with meticulous research and a clear-eyed perspective on economic challenges, participants can aim to navigate this thrilling yet complex landscape more successfully, transforming potential pitfalls into well-calculated opportunities.

Leave a Reply